Thursday, March 22, 2012

Wednesday, March 21, 2012

Apple Hits New Highs (again)

There have been plenty of warnings about Apple's stock lately. Anything that continues to rise in this manner, so say the pundits, has to come crashing back down to earth. This is true of most stocks and there are plenty of charts we could use as examples; nevertheless, those who are issuing a "sell" on AAPL are only playing the odds here. That sounds simple enough, but one has to wonder if those saying AAPL has run its course are backing their convictions by shorting the stock.

There was a "log scale" chart presented by someone the other day, which I have re-created below. The rationale was that AAPL was going to hit the trend line and must surely stop going higher once it was hit.

Time will tell.

I've never been a fan of log scale charts. While those who use them claim otherwise, I have found they distort charts and often lead to incorrect decisions.

The one thing "distorting" the charts right now is Apple, itself. Trying to get a handle on the Q's has become very difficult ... there is a monster residing within.

Sunday, March 18, 2012

US Banks Break Out vs S&P 500

No telling when it will all end.

Always perform your own due diligence. These are only my opinions.

Wednesday, March 14, 2012

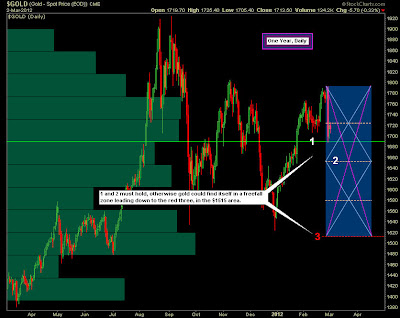

Precious Metals Continue Downward Spiral

Precious metals have fallen out of favour with the investment crowd lately, and recent activity drove the point home. It was only a couple of weeks ago physical gold was threatening to overtake two critical peaks and going full-bore bullish. Gold stocks (mainly via GDX, a one-to-one ETF) also stalled just before encountering minor peak resistance. The results have been disastrous for gold and silver bulls, dealing a serious blow to the gold (and silver) bug community.

Why the sudden turnaround?

Strength in the markets combined with renewed confidence in the US dollar has a lot to do with it. Let's not forget, money is free to go wherever it wants, and right now it is leaving the precious metals' sector and making its way into the US.

Naturally, you'll be able to read all about this latest round of precious metals' manipulation on the internet. You'll just have to do it somewhere other than here. There are plenty of blogs that cater to conspiracy theorists. It may make you feel better or it may not.

One thing is for sure: When precious metals rise it is because China and India are buying. When precious metals fall, it is because the US and a gang of banksters are naked shorting.

Do I have that about right?

Left click on chart(s) to expand

Always perform your own due diligence. These are only my opinions.

Why the sudden turnaround?

Strength in the markets combined with renewed confidence in the US dollar has a lot to do with it. Let's not forget, money is free to go wherever it wants, and right now it is leaving the precious metals' sector and making its way into the US.

Naturally, you'll be able to read all about this latest round of precious metals' manipulation on the internet. You'll just have to do it somewhere other than here. There are plenty of blogs that cater to conspiracy theorists. It may make you feel better or it may not.

One thing is for sure: When precious metals rise it is because China and India are buying. When precious metals fall, it is because the US and a gang of banksters are naked shorting.

Do I have that about right?

Left click on chart(s) to expand

Always perform your own due diligence. These are only my opinions.

Tuesday, March 13, 2012

US Dollar

It seems that it may finally be time to throw a nine year contra-indicator out the window. The dollar and the markets can indeed rise together.

Confidence in the US is one reason ... lack of confidence in other nations is also a contributing factor.

Always perform your own due diligence. These are only my opinions.

Confidence in the US is one reason ... lack of confidence in other nations is also a contributing factor.

Always perform your own due diligence. These are only my opinions.

Monday, March 12, 2012

Thursday, March 8, 2012

Gold Bugs Should Have Just Bought the Q's

Three years later, and all the fear mongering ...

Always perform your own due diligence. These are only my opinions.

Tuesday, March 6, 2012

A Bullish Day for Bears

There we have it, a wonderfully "bullish" day for the bears.

I have never quite understood all the cheerleading that takes place on so many doom and gloom sites seeking to rob honest to goodness investors of their portfolios ... but that's probably just me.

Comically, most stock market bears are also gold bugs, and they think that gold (and the precious metal stocks in their own personal portfolios) should somehow be immune to an unravelling stock market. It should also be noted these same individuals are the first to whine about the manipulative injustices to their own precious metals' portfolio while they ruthlessly short other people's holdings.

Do you see the irony of it all?

If you're an aforementioned bear, probably not.

And I don't care.

If you are willing to profit from other's despair like you are entitled to their money, you get exactly what you deserve.

Monday, March 5, 2012

Market Chatter Turns Bearish

OH NO! A pull back!

Heaven forbid the markets might want to take a breather and have some profit-takers carry the markets down for a few days. We're supposed to go straight up, after all.

When we don't, all the tekkies once again jump on the bearish bandwagon.

Where in the rule books has it ever said the markets can't continue going straight up with little more than a minor pullback?

The markets are going to do whatever they decide to do. Our mistake is thinking we've got it all figured out.

Last I checked, people have been calling for a pullback for the last two months (much longer, for some people). Impatient bears have been shorting, nervous bulls have been selling and what have the markets done?

They've continued on an upward path, despite all our educational market timing "tools."

And now, over the last few days ... finally, we get a couple of inconsequential little reversals in the markets and out comes the bear in all of us.

And what happens if we continue to go up? Bears will once again be stuck covering (like they've been doing for three years now) and nervous bulls who sold will be relegated to the sidelines waiting for the next "top" because they missed out on yet another profitable bull run and are now in the unenviable position of trying to time the "next-to-next" top so they can go short, and join forces with all the other retail bears.

If you haven't already figured it out, retail bears have been predominantly wrong since we bottomed back in 2009. Of course, this little detail hasn't stopped them from going out of their way trying to influence the bulls among us to sell everything and go short.

Go ahead and listen to the short-sellers if it makes you feel any better.

Sooner or later, if they've got any money left, retail bears are bound to be right.

Thus far, however, it looks like the big money is playing games with the little money.

Maybe I'm wrong and the big players are all hovering over the "nuke" button, waiting to see who will pull the trigger first.

Always perform your own due diligence. These are only my opinions.

Sunday, March 4, 2012

Saturday, March 3, 2012

Subscribe to:

Posts (Atom)